How Do I Avoid Paypal Fees When Sending Money

At the end of every year, I like to conduct a financial review for the past 12 months to see how my spending habits, side hustles, and general net worth have developed.

I believe it is important to take a granular look at personal finance matters alongside more general month-to-month tracking for 2 reasons:

- You can analyze broad changes in financial well-being (positive or negative).

- Tracking the income you generate from your work or various side hustles is a valuable source of encouragement.

Anyway, after looking back on the past 12 months of side hustling endeavors, I found one shockingly stupid mistake:I spent about $150 in PayPal fees in …There's just no need for this and I don't want these fees to get worse each year!

This might not seem like a big deal, but if you frequently send or receive money through PayPal, you need to know how to avoid PayPal fees to maximize your income and efforts.

This post will contain:

- A breakdown of how PayPal fees work.

- How to avoid PayPal fees.

- Alternative payment platforms to PayPal that you can consider.

Let's get to it!

Pro Tip: If you're sending money abroad, use Remitly for fast and low-fee transfers!

PayPal Business Account Fees

PayPal fees vary based on variety of factors such as the type of PayPal account you have, the purpose of the transaction (personal versus business), the currency you are dealing with, and other conditions.

If you have an online business that offers PayPal as a payment option, you will have to open aPayPal Business Account.

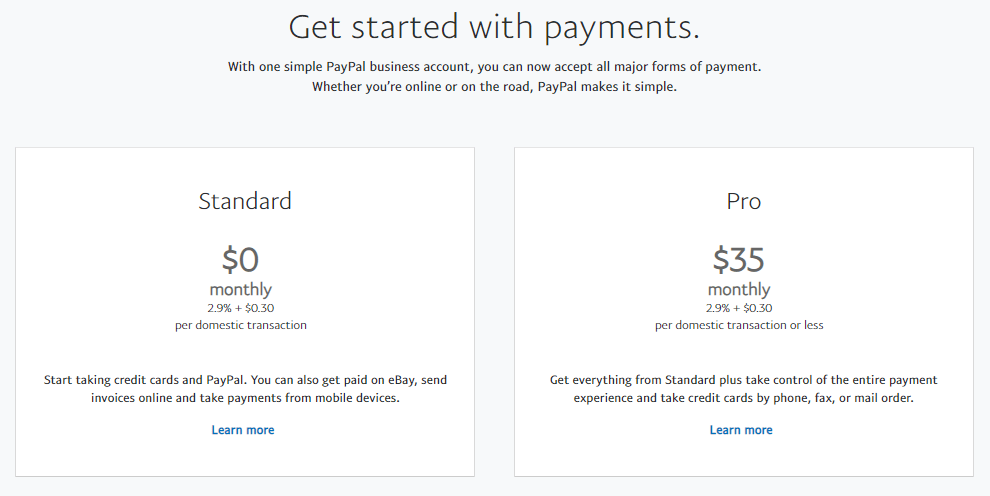

PayPal business accounts also have a variety of merchant fees or monthly cost associated with them, and are divided into Standard and Pro plans:

As a merchant, if the funds you receive come from a PayPal account in Canada, you pay a fee of 2.9% of the transaction plus $0.30 CAD.

If the funds you receive come from a PayPal account in the United States, you pay a fee of 3.7% of the transaction plus $0.30 USD.

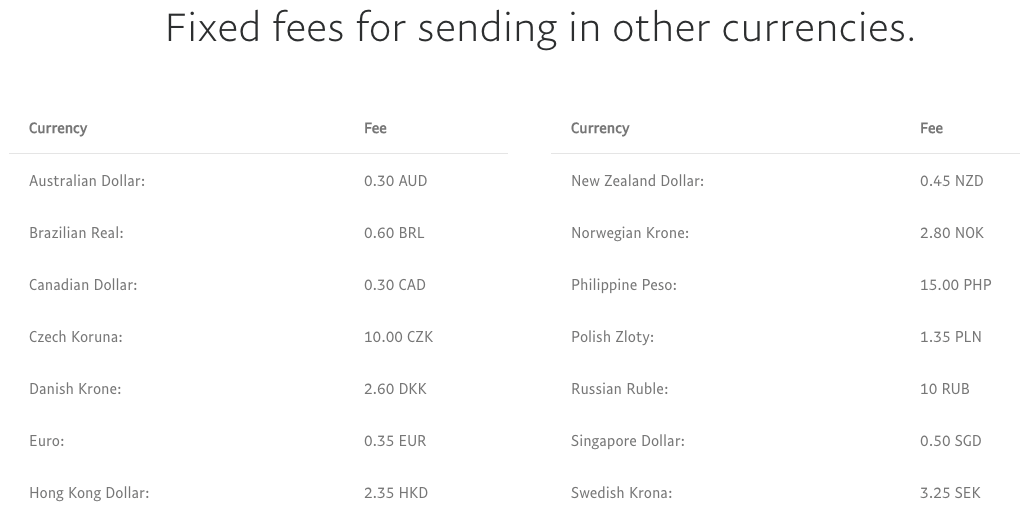

Finally, if your customer is from outside the U.S. or Canada, you will pay a fee of 3.9% of the transaction plus a fixed fee based on the currency.

PayPal Personal Account Fees:

Now, if you're a side hustler who simply uses a personal PayPal account to receive payment for your freelance work, there are also PayPal fees you should be aware of.

Personal PayPal accounts have different fee structures based on your country of residence, but I am going to citeU.S. PayPal fee informationfor this section.

For U.S. personal PayPal accounts:

- Buying is free within the United States (also the case in Canada).

- Sending money is free if the transfer is funded by your PayPal balance or bank account linked to your PayPal account (you are charged 2.9% plus a fixed fee if funded by a credit/debit card or PayPal credit).

- Transferring money from your PayPal account to your linked bank account is free, but instant transfers charge 1% of the amount transferred up to a maximum of $10.

PayPal also charges a currency conversion fee in scenarios such as:

- When you purchase goods sold in a currency you do not personally have in your account.

- When you send money in a currency you do not have in your account.

- When you receive money in a currency your PayPal account is not configured to accept.

- When you withdraw money to your linked bank account that is in a different currency than your bank holds.

PayPal's currency conversion fee is 3.0% for Canadian or U.S. dollars and 3.5% for all other currencies.

The actual base exchange rate is based on rates from wholesale currency markets on the given day or prior business day depending on the time of transaction.

How to Avoid PayPal Fees

The strategies you use to avoid PayPal fees will vary depending on the type of account you have, so I will outline some tips for businessandpersonal accounts.

1. Change Payment Structure/Frequency

If you operate an online ecommerce business or something like a dropshipping business that sells one-time products to consumers, this strategy won't help you avoid PayPal fees.

However, if you operate a business model that charges your customers for recurring services (i.e. consulting work, subscriptions, coaching), you can save a lot of money simply by altering your payment model and frequency of invoicing.

For example, if you have customers who are paying you through PayPal on a bi-weekly or even weekly basis for your services, switching to a monthly payment schedule will reduce the number of times you are charged a $0.30 transaction fee.

Granted, this isn't much, but if you have a high amount of transactions it can add up to some decent savings.

2. Utilize PayPal Friends and Family Invoicing

PayPal friends and family payments work slightly differently than normal transactions.

According to PayPal: "If the request is for goods and services, invoice fees are only 2.9% + $0.30 per paid request. If you're requesting money from friends & family on our app or using PayPal online, it's free to receive money."

If you're a freelancer or business owner looking to cut back on PayPal transaction fees, you can use the friends and family feature to avoid them completely.

However, you really need to ensure your clients are completely comfortable with this option and that you have been doing business together for a while.

Buyers lose their payment protection if they send money through the friend and family option, so using this trick to avoid PayPal fees might take some convincing and trust.

However, you could opt to split the 2.9% in fee savings with the client to incentivize them to use the PayPal friends and family feature.

3. Claim PayPal Fees on your Tax Return

If your side hustle generates a significant amount of annual revenue and you decide to actually start a business, you should consider any PayPal fees you incur when doing your taxes.

If you pay PayPal fees as a business, you can actually include these on your efile tax return because they are an inevitable cost of your business operations and may allow you to find some tax deductions.

You'll have to document the amount of money you pay in PayPal fees throughout the year to accomplish this, but this could be worth your while if you process a lot of PayPal transactions each calendar year.

You can use popular programs like FreshBooks, TurboTax, QuickBooks, Zoho Books or plenty of other software options to help make sense of your business taxes and what to do for tax returns.

Extra reading – See how the Hurdlr App can help save even more money during tax season for freelancers, drivers, or real estate agents.

4. Plan your Cash Flow Needs in Advance

You can withdraw your PayPal funds to your linked bank account without incurring any fees. However, if you opt for an instant transfer, you will pay 1% of the total transaction up to $10.

One of the simplest ways to avoid PayPal fees is to just have patience. Plan your cash flow needs in advance, and never use instant transfers to withdraw money to your linked bank account (just use the normal withdrawal method).

5. Apply For A PayPal Cash Card

Another option for not getting charged on PayPal is to use a PayPal cash card.

This card acts like a debit card and lets you spend your PayPal funds wherever Mastercard is accepted.

Perks of the PayPal cash card include:

- No monthly fees

- No minimum account balance

- No credit check

- Zero transaction fees

You can also withdraw cash worldwide at over 32,000 fee-free MoneyPass ATMs.

So, this card is really the best of both worlds.

You can avoid paying PayPal fees when receiving money if it's in the same currency you normally spend with.

Then, you can turn around and spend money directly from your account without worrying about fees or monthly account costs.

6. Open a New Bank Account (Especially if you're Canadian)

The main way I incurred PayPal fees in 2019 was when I transferred $USD from my PayPal account to my linked Canadian bank account.

Freelancing or making money online can be an international affair. Chances are, you will eventually have to deal with a currency that is not used in your native country if you work online.

For residents outside the United States this tip is a particularly useful way to reduce PayPal fees (since a great deal of online transactions usually use $USD).

There are plenty of low-fee or zero-fee bank account options for Canadians looking to open a U.S. bank account, and I actually opened one this year that just cost $29. I can now withdraw my $US PayPal funds to that account without worrying about transaction/conversions fees.

If you receive a lot of $USD for your online work, I highly suggest looking into opening a U.S. bank account if you can to avoid paying PayPal fees on currency conversions.

7. Ask To Be Paid In A Specific Currency

One simple way to avoid paying fees on foreign currency conversions is to simply state in your contract that you need to be paid in your native currency.

I've hired freelancers for web development and SEO before and seen two freelancers do this (they requested $USD for their work). This is quite common for $USD, but you might be able to get away with it for other major currencies around the world.

8. Plan Ahead with Pricing

If you receive PayPal payments for most of your online work, you should definitely consider this when determining how you price your services.

I'm against the idea of making clients cover PayPal fees, and I don't suggest setting wonky pricing like $52.43 or anything like that, but just calculate anticipated fees in the back of your mind when setting your prices.

This is especially useful if you are going to start a side hustle like flipping items on eBay where you will have to consider both eBay and PayPal fees in your margin calculations.

9. Apply For Micropayments

If you frequently accept payments for less than $10 on PayPal, you can signup for a micropayment model.

Paypal micropayments are great for merchants doing a serious volume of low cost transactions. As a merchant, you will have to pay 5% of the transaction fee for U.S. customers and 6.5% for international customers.

You'll have to apply for this option and have your PayPal account be in good standing. However, paying a micropayment fee makes way more sense than paying 2.9% + $0.30 per transaction on small deals.

10. Use Harvest & PayPal Business Payments

If you deal with invoices frequently as a business owner or freelancer, using Harvest to organize your payments is a great way to pay fewer PayPal fees.

Harvest lets you easily invoice clients, track ongoing projects, manage expenses, and even save money. It's incredibly easy to integrate Harvest to PayPal and to manage incoming and outgoing invoices, and you can also save money in the process.

If you setup PayPal Business Payments with Harvest, you are charged a fixed fee of $0.50 per transaction instead of the regular percentage-base fee. This is a win-win for businesses and freelancers alike as it keeps more money in everyone's pocket (except for PayPal).

Harvest has a 30 day free trial, and the free version also lets you manage up to 2 projects for free. The paid version, which allows for unlimited users and projects, is only $10.80 when billed annually ($12 monthly otherwise).

If you want to avoid PayPal fees, using Business Payments with invoicing software like Harvest is definitely the way to go.

Signup for Harvest with my link and get a $10 credit!

11. Consider Alternative PayPal Options

There are plenty of other payment platforms besides PayPal, and you can also consider them if you think they will suit your needs better.

Some useful PayPal alternatives include:

TransferWire:Especially useful for sending international transfers in different currencies (done through bank transfers).

Payoneer:Useful because you get a Payoneer debit card, but you also have to pay a monthly fee and fees when you withdraw money to another bank account.

Skrill:Very similar to PayPal, except Skrill offers users a debit card and money can be sent or transferred incredibly quickly to this debit card account.

Dwolla:Dwolla charges a $0.25 transaction fee on any amount over $10, but making bank transfers with Dwolla is fast and simple. Dwolla only works in the United States and both sender and receiver need to both be on Dwolla for transactions to work, so keep this in mind!

Stripe:I had to open a Stripe account when I started making money on Medium, and I actually like Stripe! Stripe is definitely the most popular alternative to PayPal, and the platform is handy because it automatically deposits money to your bank account. Fees are pretty similar to PayPal fees, and setup is very simple.

You can also read our post on Cash App vs PayPal for another breakdown of an alternative payment solution!

12. Accept Other Payment Methods

While this is a simple way to avoid paypal fees when receiving money, it's sometimes the easiest.

If you can get paid through check or direct deposit, you'll skip the entire PayPal hassle entirely.

Of course, you need to make sure your client/customer is alright with this, but it's always worth asking the question.

Besides, if you're working with a large company, they probably prefer paying you directly and working with a bank instead of PayPal!

Final Thoughts

At the end of the day, losing $50-$100 a year on PayPal fees might not seem like the end of the world. After all, as long as you are running a profitable online business or making money with a blog, should you really care?

Well…I think the answer is yes: you should care.

Learning how to avoid PayPal fees in the early stages of your side hustling can help you save thousands of dollars in the long run, and you can use your savings to invest back into your business or simply grow your savings.

None of these strategies are rocket science, but hopefully you can use some of the ideas in my list to stop paying PayPal fees and maximize the effectiveness of your side hustles.

Catch you guys in the next post!

Tom is a 24 year old recent college graduate from Canada with a passion for side hustling, passive income, and marketing. This Online World is all about providing people with honest ways to make and save more money by using technology. To learn more about Tom, read his About Page!

If you're interested in freelance writing services or want to partner with This Online World, please visit Tom Blake Digital to get in touch!

How Do I Avoid Paypal Fees When Sending Money

Source: https://thisonlineworld.com/avoid-paypal-fees/

Posted by: pruittaccultoo1942.blogspot.com

0 Response to "How Do I Avoid Paypal Fees When Sending Money"

Post a Comment